입력 : 2025.12.10 14:21

Blueground opens 24 locations in Seoul within six months

[Korea Real Estate Media Ddangzipgo] Louis Vuitton Korea recently secured rare long-term short-stay accommodation for one of its foreign executives in Seoul’s Dongdaemun District. The company signed a one-year lease for a fully furnished two-bedroom unit operated by global short-term rental firm Blueground in the Jaileune complex adjacent to Sinseol-dong Station. Monthly rent, including management fees, is around 4 million won (approx. US$3,000).

A Louis Vuitton Korea official said demand has intensified as more expatriates rotate into Seoul: “Finding suitable, reliable housing for foreign executives has become challenging. We were relieved to find Blueground, a brand trusted by global corporate clients.”

☞Blueground, a premium rental platform for high-end homes

[Korea Real Estate Media Ddangzipgo] Louis Vuitton Korea recently secured rare long-term short-stay accommodation for one of its foreign executives in Seoul’s Dongdaemun District. The company signed a one-year lease for a fully furnished two-bedroom unit operated by global short-term rental firm Blueground in the Jaileune complex adjacent to Sinseol-dong Station. Monthly rent, including management fees, is around 4 million won (approx. US$3,000).

A Louis Vuitton Korea official said demand has intensified as more expatriates rotate into Seoul: “Finding suitable, reliable housing for foreign executives has become challenging. We were relieved to find Blueground, a brand trusted by global corporate clients.”

☞Blueground, a premium rental platform for high-end homes

◇Short-term rental market surges as foreign arrivals hit record levels

With foreign visitor numbers climbing sharply, Seoul’s short-term rental market is expanding at an unprecedented pace. These rentals generally operate on flexible terms—from one week up to one year—targeting foreigners who previously relied primarily on hotels or Airbnb listings. But after a government crackdown in October that removed large numbers of unregistered Airbnb units, demand has shifted toward professionally managed, legally compliant operators.

Since entering Korea in late April, Blueground—the world’s largest global operator in the flexible-stay sector—has opened 24 locations across Seoul within just six months. Foreigners account for roughly 90% of its tenants. Most are expatriate staff of multinational corporations, staying an average of four to five months. Occupancy rates consistently exceed 90%, leaving virtually no vacant units.

Custom requests from corporations, foreign missions, and international organizations are also rising. In October, a European embassy signed a one-year lease for a 43㎡ one-bedroom apartment near Gangnam Station for 70 million won. Japanese logistics firm NTL Nittsu Line Korea leased a one-bedroom near Chungmuro Station for six months to house an incoming Japanese employee.

“Compared with hotels, our units cost 20–30% less while offering higher satisfaction for long-stay employees,” said Blueground Korea CEO Jung Eul-yong. “Corporate and institutional inquiries continue to grow.”

☞Blueground, a premium rental platform for high-end homes

◇Foreign resident population hits record high, but suitable accommodation remains scarce

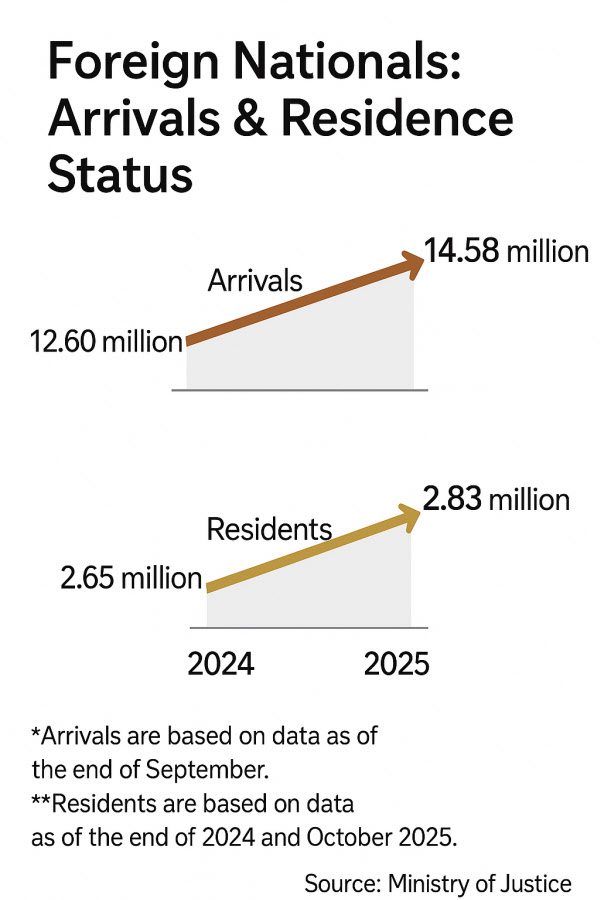

Competition is intensifying as local operators such as Encostay enter the market targeting the foreign workforce. According to the Ministry of Justice, 14.58 million foreigners entered South Korea between January and October this year, up more than 15% from the same period last year (12.6 million). The number of foreigners residing long-term for business, study, or employment has reached an all-time high of 2.83 million—up nearly 200,000 from late last year.

Yet supply has not kept pace. Many hotels shut down during the pandemic, and surviving five-star hotels now operate at over 90% occupancy. Tightened enforcement against unregistered Airbnb-style rentals has further concentrated demand into the limited hotel inventory, driving up accommodation costs.

“Both short-term visitors and long-term foreign residents are increasing each year, but supply is far from sufficient,” Jung said. “Demand will continue to outstrip availability, and the short-term rental market is likely to grow for the foreseeable future.”/hongg@chosun.com

This article has been translated by ChatGPT.